The abandonment of the gold standard in 1971 is closely tied to the massive unemployment the industrialized world has suffered in recent years; Mexico, even with a lower level of industrialization than the developed countries, has also lost jobs due to the closing of industries; in recent years, the creation of new jobs in productive activities has been anemic at best.

The world’s financial press, in which leading economists and analysts publish their work, never examines the relationship between the abandonment of the gold standard and unemployment, de-industrialization, and the huge chronic export deficits of the Western world powers. Might it be due to ignorance? We are reluctant to think so, given that the articles appearing in the world’s leading financial publications are written by quite intelligent analysts. Rather, in our opinion, it is an act of self-censorship to avoid incurring the displeasure of the important financial and geopolitical interests that are behind the financial press.

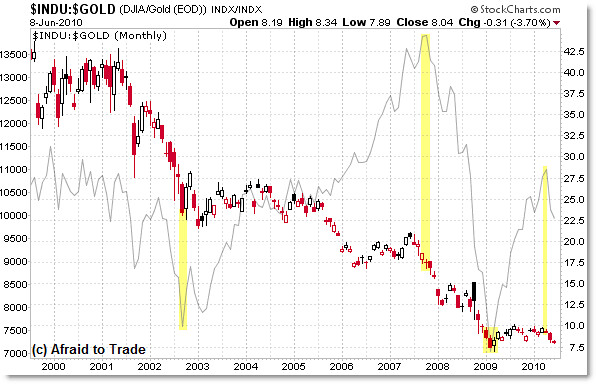

In this article we discuss the relationship between loss of the gold standard and the present financial chaos, which is accompanied by severe “structural imbalances” between the historically dominant industrial powers and their new rivals in Asia.

http://www.zerohedge.com/article/global-financial-crisis-dummies-why-abandonment-gold-standard-responsible-worlds-sovereign-d

------------------------Check out the rest of this blog here.