Socialism and debt, what a way to run an economy :(

http://www.guardian.co.uk/business/interactive/2008/nov/05/interest-rates-history

------------------------

Check out the rest of this blog here.

I started this blog in June 2007 asking these questions: Are we in a massive asset bubble that will blow up in our faces ??? - ANSWERED YES ! Is western and particularly British society on the verge of social collapse??? What are the best common sense long term investment strategies to keep you rich? When will consumption/debt bubble economics end and a real savings/production economy begin ???

Tuesday 31 March 2009

Dollar setting up for a big fall ?

http://blog.afraidtotrade.com/us-dollar-index-pulls-back-to-the-cradle/

------------------------

Check out the rest of this blog here.

The Soviet Union and the GDR didn't have recessions !

http://blogs.telegraph.co.uk/daniel_hannan/blog/2008/11/13/why_so_many_freemarketeers_backed_the_bailout

------------------------

Check out the rest of this blog here.

Sunday 29 March 2009

Saturday 28 March 2009

The biggest stock market scam of the century is now underway, hatched, given the stamp of approval, and about to be executed by Central Banks

In conclusion, if a U.S. Federal Reserve inspired bounce occurs in the U.S. stock markets, if a Bank of England bounce occurs in the U.K. stock markets, if a ECB inspired bounce occurs in any European stock market and so on, this is a doomsday scenario for investors as it can only happen if the Central Banks’ plan of money supply expansion and monetary valuation implosion succeeds.

And if it does, they will have pulled off in essence the biggest stock market scam of the century under the guise of a massive global monetary devaluation scheme that very few people will fully understand. Realizing the implication of the above charts as well as the likely effects of these Central Banks policies on the world’s money supply should scare the hell out of everyone to a far greater degree than $50 billion Ponzi schemes and $200 million bonuses to failed financial companies.

In writing this article, I am not asking anyone to blindly agree with me, but I do hope that this article inspires enough of you to forward this article to everyone you know so that we can foster a truly intelligent debate about this matter. In the process of starting an intelligent debate, we will educate instead of misinform, gain more clarity about the origins of this crisis instead of shrouding it in secrecy, and ultimately, illuminate the true culprits of this deepening global economic crisis – the Central Banks.

http://seekingalpha.com/article/127513-will-the-fed-s-overkill-succeed

------------------------

Check out the rest of this blog here.

Friday 27 March 2009

Milton Friedman - Greed is Good, Greed Works

The only alternative to having greed organise society is soviet style commissars:

Friedman being attacked by hippie communist students in 1978, if they were so unhappy why did they not go and live in East Germany ?

------------------------

Check out the rest of this blog here.

Friedman being attacked by hippie communist students in 1978, if they were so unhappy why did they not go and live in East Germany ?

------------------------

Check out the rest of this blog here.

Hyper-depression is simply stagflation squared: The 70s are back and this time it's personal !

Thus far, this enormous injection of new reserves into the banking system hasn't caused the CPI to explode, but that is because (a) the banks are mostly sitting on the new reserves because they are all terrified, and (b) the public's demand for cash balances has risen sharply. But using very back-of-the-envelope calculations, there is now enough slack in the system so that if banks calmed down and lent out the maximum amount of reserves, the public's total money stock could increase by a factor of 10. There is no way that the public will simply add that new money to its checking accounts or home safes without increasing their spending. Eventually, prices quoted in U.S. dollars will start shooting upward.

All of the financial analysts are aware of this threat, but they foolishly reassure us, "Bernanke will unwind the Fed's holdings once the economy improves." But this commits the same mistake as the Keynesians during the 1970s: What happens when the CPI begins rising several percentage points per month, and unemployment is still in the double digits? What would Bernanke do at that point? Expecting the Fed chief to relinquish his new role of buying hundreds of billions in assets at whim, in the midst of a severe recession, would be akin to hoping that a dictator would end his declaration of "emergency" martial law in the middle of a civil war.

There are even many free market economists who are predicting that the Fed's massive money-pumping will "fix" the economy, at least for a while, but at the cost of high price inflation. Yet these analysts don't realize that they are buying into - what we all thought was - the discredited Phillips Curve. The 1970s proved that the Fed cannot fix structural problems with the economy by showering it with new money. Hyper-depression is simply stagflation squared.

http://www.dailyreckoning.com.au/the-threat-of-hyper-depression/2009/03/26/

------------------------

Check out the rest of this blog here.

British police state encourages people to spy on their neighbours much like the GDR !

http://en.wikipedia.org/wiki/East_Germany

http://en.wikipedia.org/wiki/Strategy_of_tension

------------------------

Check out the rest of this blog here.

Thursday 26 March 2009

Who gets a bailout ???

| South Park | Wed 10pm / 9c | |||

| Bailout! | ||||

| comedycentral.com | ||||

| ||||

------------------------

Check out the rest of this blog here.

Credit crunch will lead to oil shock in six months ?

The global financial crisis and collapse in the oil market have stalled vital investment in oil exploration and production and are likely soon to lead to a sharp spike in prices, an energy consultant and financier says.

Matt Simmons, founder of Houston-based investment bank Simmons & Co, argues the underlying rate of decline of the world's ageing oilfields is as much as 20 percent a year and only high levels of investment can reduce that to single digits.

With credit tight and oil prices almost $100 a barrel below their highs last year, oil companies are unable to sustain previous levels of spending and the result is falling production, he said in an interview on Thursday.

"We are three, six, maybe nine months away from a price shock. We are not talking about three to five years away -- it will be much sooner," Simmons told Reuters in London.

"These prices now are dangerously low. The lower prices fall, the less oil will be produced and the greater the chance of an oil spike," he said.

Oil prices hit record highs of almost $150 per barrel last July but have tumbled since then as the global economic downturn has cut energy consumption by consumers and companies alike.

Prices have rallied from lows below $35 a barrel in December to above $50 but remain well below what many oil companies and producing countries say they need to invest in new production.

more ...

------------------------

Check out the rest of this blog here.

US Cities Deal With a Surge in Shanty Towns

As the operations manager of an outreach center for the homeless here, Paul Stack is used to seeing people down on their luck. What he had never seen before was people living in tents and lean-tos on the railroad lot across from the center.

“They just popped up about 18 months ago,” Mr. Stack said. “One day it was empty. The next day, there were people living there.”

Like a dozen or so other cities across the nation, Fresno is dealing with an unhappy déjà vu: the arrival of modern-day Hoovervilles, illegal encampments of homeless people that are reminiscent, on a far smaller scale, of Depression-era shantytowns. At his news conference on Tuesday night, President Obama was asked directly about the tent cities and responded by saying that it was “not acceptable for children and families to be without a roof over their heads in a country as wealthy as ours.”

more ...

------------------------

Check out the rest of this blog here.

Gordon Brown is the modern day 'reverse' robin hood. Robbing from the poor (via inflation) to feed the rich

http://ukhousebubble.blogspot.com/2009/03/ten-reasons-why-inflation-will.html

------------------------

Check out the rest of this blog here.

Wednesday 25 March 2009

Pupils to study Twitter and blogs in UK primary schools - WTF !

Children will no longer have to study the Victorians or the second world war under proposals to overhaul the primary school curriculum, the Guardian has learned.

However, the draft plans will require children to master Twitter and Wikipedia and give teachers far more freedom to decide what youngsters should be concentrating on in classes.

The proposed curriculum, which would mark the biggest change to primary schooling in a decade, strips away hundreds of specifications about the scientific, geographical and historical knowledge pupils must accumulate before they are 11 to allow schools greater flexibility in what they teach.

more ...

------------------------

Check out the rest of this blog here.

However, the draft plans will require children to master Twitter and Wikipedia and give teachers far more freedom to decide what youngsters should be concentrating on in classes.

The proposed curriculum, which would mark the biggest change to primary schooling in a decade, strips away hundreds of specifications about the scientific, geographical and historical knowledge pupils must accumulate before they are 11 to allow schools greater flexibility in what they teach.

more ...

------------------------

Check out the rest of this blog here.

U.K. Gilts Slump After First ‘Failed’ Bond Auction Since 1995

U.K. gilts slumped after demand at an auction of bonds fell short of the amount offered, the first time the Treasury failed to attract enough bids at a sale of regular debt in 14 years.

Investors bid for 1.63 billion pounds ($2.4 billion) of the 40-year securities, less than the 1.75 billion pounds of 4.25 percent notes slated for sale, the U.K. Debt Management Office said today in a statement from London.

more ...

------------------------

Check out the rest of this blog here.

Investors bid for 1.63 billion pounds ($2.4 billion) of the 40-year securities, less than the 1.75 billion pounds of 4.25 percent notes slated for sale, the U.K. Debt Management Office said today in a statement from London.

more ...

------------------------

Check out the rest of this blog here.

10 Reasons Why We Still Haven't Hit Bottom

Don’t get me wrong, I love this bear market rally. It makes me feel good. Makes me feel wealthier. Makes me feel more confident. But is it warranted? Even if it isn’t, sometimes just thinking the worst has passed helps the market recover more quickly than previously thought possible.

But remember, bear market rallies are usually the largest. And if you look into it, not much has changed but psychology. Here are my top ten reasons for why the worst may still be to come.

http://seekingalpha.com/article/127105-10-reasons-why-we-still-haven-t-hit-bottom?source=article_sb_popular

------------------------

Check out the rest of this blog here.

Tuesday 24 March 2009

Daniel Hannan, MEP for South East England, gives a speech during Gordon Brown´s visit to the European Parliament on 24th March, 2009

The engorgement of the unproductive UK public sector at the expense of the productive private sector is a national disgrace !

------------------------

Check out the rest of this blog here.

------------------------

Check out the rest of this blog here.

Recession or no recession, many NFL, NBA and Major League Baseball players have a penchant for losing most or all of their money

What the hell happened here? Seven floors above the iced-over Dallas North Tollway, Raghib (Rocket) Ismail is revisiting the question. It's December, and Ismail is sitting in the boardroom of Chapwood Investments, a wealth management firm, his white Notre Dame snow hat pulled down to his furrowed brow.

In 1991 Ismail, a junior wide receiver for the Fighting Irish, was the presumptive No. 1 pick in the NFL draft. Instead he signed with the CFL's Toronto Argonauts for a guaranteed $18.2 million over four years, then the richest contract in football history. But today, at a private session on financial planning attended by eight other current or onetime pro athletes, Ismail, 39, indulges in a luxury he didn't enjoy as a young VIP: hindsight.

"I once had a meeting with J.P. Morgan," he tells the group, "and it was literally like listening to Charlie Brown's teacher." The men surrounding Ismail at the conference table include Angels outfielder Torii Hunter, Cowboys wideout Isaiah Stanback and six former pros: NFL cornerback Ray Mickens and fullback Jerald Sowell (both of whom retired in 2006), major league outfielder Ben Grieve and NBA guard Erick Strickland ('05), and linebackers Winfred Tubbs ('00) and Eugene Lockhart ('92). Ismail ('02) cackles ruefully. "I was so busy focusing on football that the first year was suddenly over," he says. "I'd started with this $4 million base salary, but then I looked at my bank statement, and I just went, What the...?"

Before Ismail can elaborate on his bewilderment—over the complexity of that statement and the amount of money he had already lost—eight heads are nodding, eight faces smiling in sympathy. Hunter chimes in, "Once you get into the financial stuff, and it sounds like Japanese, guys are just like, 'I ain't going back.' They're lost."

more ...

------------------------

Check out the rest of this blog here.

In 1991 Ismail, a junior wide receiver for the Fighting Irish, was the presumptive No. 1 pick in the NFL draft. Instead he signed with the CFL's Toronto Argonauts for a guaranteed $18.2 million over four years, then the richest contract in football history. But today, at a private session on financial planning attended by eight other current or onetime pro athletes, Ismail, 39, indulges in a luxury he didn't enjoy as a young VIP: hindsight.

"I once had a meeting with J.P. Morgan," he tells the group, "and it was literally like listening to Charlie Brown's teacher." The men surrounding Ismail at the conference table include Angels outfielder Torii Hunter, Cowboys wideout Isaiah Stanback and six former pros: NFL cornerback Ray Mickens and fullback Jerald Sowell (both of whom retired in 2006), major league outfielder Ben Grieve and NBA guard Erick Strickland ('05), and linebackers Winfred Tubbs ('00) and Eugene Lockhart ('92). Ismail ('02) cackles ruefully. "I was so busy focusing on football that the first year was suddenly over," he says. "I'd started with this $4 million base salary, but then I looked at my bank statement, and I just went, What the...?"

Before Ismail can elaborate on his bewilderment—over the complexity of that statement and the amount of money he had already lost—eight heads are nodding, eight faces smiling in sympathy. Hunter chimes in, "Once you get into the financial stuff, and it sounds like Japanese, guys are just like, 'I ain't going back.' They're lost."

more ...

------------------------

Check out the rest of this blog here.

Monday 23 March 2009

Sunday 22 March 2009

10 Business Lessons From 'Battlestar Galactica'

You think your business has it rough? The people of Battlestar Galactica have lived through a recession you wouldn't believe. With dwindling resources, a skeleton crew, enemies constantly lurking out of view, and a pervasive threat of annihilation, Admiral Adama navigates the vast unknown. Like any leader, he makes his share of mistakes--sometimes with devastating consequences. But regardless of the fate of that ragtag fleet, the tale of Galactica is rife with lessons that can benefit any business leader.

more ...

------------------------

Check out the rest of this blog here.

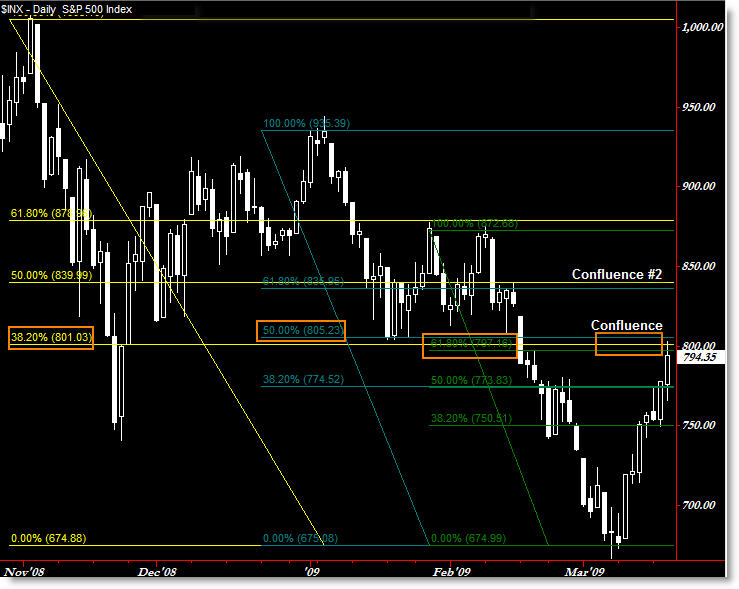

Main indexes hitting Fibonacci Confluence levels pointing to the final big down move soon ?

http://blog.afraidtotrade.com/triple-fibonacci-confluence-at-800-on-sp500/

http://blog.afraidtotrade.com/fibonacci-confluence-on-nasdaq-and-dow-jones/

------------------------

Check out the rest of this blog here.

Saturday 21 March 2009

The Job

http://cosmos.bcst.yahoo.com/up/player/popup/?rn=3906861&cl=12582289&ch=4226720&src=news

------------------------

Check out the rest of this blog here.

Friday 20 March 2009

Is the public sector the engine of the fake uk economy ?

More than 138,000 people began claiming the Jobseekers' Allowance in February, taking the total number of claimants up to 1.39 million, the Office for National Statistics said.

But while private sector firms have cut jobs and pay to cope with the downturn, the only area that saw employment rise was the public sector, which created 30,000 positions last year and saw average salaries increase faster than inflation.

http://www.telegraph.co.uk/finance/jobs/5013524/Unemployment-hits-two-million-but-public-sector-sheltered.html

------------------------

Check out the rest of this blog here.

Thursday 19 March 2009

DOLLAR CRISIS IN THE MAKING

Increasingly ominous clouds are gathering in what could soon be the perfect storm against the United States dollar and against the present dollar-centric global financial order.

This is not shaping up to be a storm that anyone is trying to initiate, not even those who are actively driving for a new global financial order that is no longer centered on the dollar. Instead, it will result from a correlation of forces arising out of the deepening global financial and economic crises, coupled with recurring and conspicuous miscalculation on the part of some of the world's political, financial and economic leaders.

The storm has the potential to cause upheaval on a grand scale, opening the door to swift, and largely uncontrolled, fundamental transformation.

more ...

------------------------

Check out the rest of this blog here.

Wednesday 18 March 2009

Crude oil Bull Market Turning Point ?

http://www.kitco.com/ind/vermeulen/mar132009.html

http://www.thestreet.com/story/10473383/1/title-fight-gold-vs-oil.html

http://blog.afraidtotrade.com/video-analysis-in-crude-oil-surviving-80/

http://blog.afraidtotrade.com/a-daily-look-at-crude-oil-developing-reversal/

------------------------

Check out the rest of this blog here.

Doom and Gloomers make economic predictions for the next 30 years

These warnings and predictions were often derided as just negative nonsense coming from alarmists, ‘party poopers’, ‘Chicken Littles’, ‘perma-bears’, ‘doom and gloomers’ and the like rather than from the insightful economists and financial and market analysts who made them. To their collective credit they were all substantially correct in their prognoses of what we could expect to happen as exemplified by what has occurred (and is still occurring) over the past 6 months. It has cost many investors 50+% of their stock market investments, 20 - 30% of the value of their home or even the loss of their house itself. Perhaps we should have paid more attention to what they said and as I compiled in the 6-part series back in 2006 regarding the “Ominous Warnings and Dire Predictions of World’s Financial Experts” followed up by a 4-part series entitled “Warning! Fiscal Hurricane Approaching! Is Your Portfolio Secure?”

Once again warnings and predictions are being put forth about the next crisis to befall us and this time round it behooves us to pay more attention and make sure this time that we are better positioned to survive and prosper whatever comes our way. Below are major market forecasts and investment advice based on drastically different analytical styles (demographic, fundamental, technical and ‘socionomic’) from forecasters who have ‘been there, done that’ successfully in the past and are once again forecasting what their research indicates is in store for us over the next decade. It should be ignored at our peril.

more ...

------------------------

Check out the rest of this blog here.

Once again warnings and predictions are being put forth about the next crisis to befall us and this time round it behooves us to pay more attention and make sure this time that we are better positioned to survive and prosper whatever comes our way. Below are major market forecasts and investment advice based on drastically different analytical styles (demographic, fundamental, technical and ‘socionomic’) from forecasters who have ‘been there, done that’ successfully in the past and are once again forecasting what their research indicates is in store for us over the next decade. It should be ignored at our peril.

more ...

------------------------

Check out the rest of this blog here.

Tuesday 17 March 2009

Why the Meltdown Should Have Surprised No One by: Peter Schiff

Excellent distillation of the Austrian position:

The Henry Hazlitt Memorial Lecture. Recorded 13 March 2009 at the Ludwig von Mises Institute in Auburn, Alabama.

http://mises.org/media.aspx?action=search&q=schiff

http://en.wikipedia.org/wiki/Peter_Schiff

http://en.wikipedia.org/wiki/Austrian_School_of_Economics

------------------------

Check out the rest of this blog here.

The Henry Hazlitt Memorial Lecture. Recorded 13 March 2009 at the Ludwig von Mises Institute in Auburn, Alabama.

http://mises.org/media.aspx?action=search&q=schiff

http://en.wikipedia.org/wiki/Peter_Schiff

http://en.wikipedia.org/wiki/Austrian_School_of_Economics

------------------------

Check out the rest of this blog here.

Hugh Hendry vs Liam Halligan: Big inflation coming to the UK soon

http://www.telegraph.co.uk/comment/personal-view/4742855/Inflation-is-the-greatest-danger-to-the-British-economy.html

------------------------

Check out the rest of this blog here.

Monday 16 March 2009

The highest levels of the Obama administration are infested with members of a shadowy, elitist cabal intent on installing a one-world government

“I don’t laugh at the people who claim that they understand the connections, but I’ve never really spent much time tracing that through,” said Rep. Ron Paul (R-Texas), a former presidential candidate whose libertarian sensibilities have made him a darling of the Bilderberg conspiracists.

“The one thing that concerns me is that the people who surround Obama or Bush generally come from the same philosophic viewpoint and they have their organizations – they have the Trilateral Commission, the CFR [Council on Foreign Relations] and the Bilderbergers, and they’ve been around a long time. And my biggest concern is what they preach: Keynesian economics and interventionism and world planning,” he said.

http://www.politico.com/news/stories/0309/20010.html

------------------------

Check out the rest of this blog here.

Sunday 15 March 2009

Friday 13 March 2009

Flooding an economy with easy credit makes everyone rich, right ???

I am tired of hearing economists argue that government and the Fed should expand credit for the good of the economy. Sometimes an analogy clarifies a subject, so let's try one.

It may sound crazy, but suppose the government were to decide that the health of the nation depends upon producing Jaguar automobiles and providing them to as many people as possible.

To facilitate that goal, it begins operating Jaguar plants all over the country, subsidizing production with tax money. To everyone's delight, it offers these luxury cars for sale at 50% off the old price. People flock to the showrooms and buy.

Later, sales slow down, so the government cuts the price in half again. More people rush in and buy. Sales again slow, so it lowers the price to $900 each. People return to the stores to buy two or three, or half a dozen. Why not? Look how cheap they are! Buyers give Jaguars to their kids and park an extra one on the lawn. Finally, the country is awash in Jaguars.

more ...

------------------------

Check out the rest of this blog here.

It may sound crazy, but suppose the government were to decide that the health of the nation depends upon producing Jaguar automobiles and providing them to as many people as possible.

To facilitate that goal, it begins operating Jaguar plants all over the country, subsidizing production with tax money. To everyone's delight, it offers these luxury cars for sale at 50% off the old price. People flock to the showrooms and buy.

Later, sales slow down, so the government cuts the price in half again. More people rush in and buy. Sales again slow, so it lowers the price to $900 each. People return to the stores to buy two or three, or half a dozen. Why not? Look how cheap they are! Buyers give Jaguars to their kids and park an extra one on the lawn. Finally, the country is awash in Jaguars.

more ...

------------------------

Check out the rest of this blog here.

Thursday 12 March 2009

Ignoring the Austrians Got Us in This Mess but the NY Times thinks it was all the Chicago School's fault !

But to say that anyone who is a serious student of economics is not thoroughly familiar with Keynes' ideas beggars credulity. The standard construct of the economy used by virtually all forecasters, from the Federal Reserve on down, is basically Keynesian, with varying opinions about how the model works. That none of them predicted the current crisis is telling, and indeed damning of the approach.

What definitely is ignored in academe is the Austrian school of economics, especially for baby boomers brought up on Samuelson's economics text, which was pure Keynesian orthodoxy. I did not learn the names von Mises and Hayek or their ideas until a decade or more after graduation (with a degree in economics, by the way.)

The Austrian view is a mirror image on the right to Minsky's from the left. The economy, if left alone, is self-correcting, say the Austrians. But central banks' inflationary expansion of credit produces booms and malinvestments, which inevitably lead to a crashes and depressions.

The only prevention for boom and busts are sound money, which is impossible with government-controlled central banks. Once the bust comes, the only cure is to let it run its course; allow the malinvestments go bankrupt and let the market reallocate the capital to productive uses.

The most famous expression of that philosophy was the prescription of Treasury Secretary Andrew Mellon: "Liquidate labor, liquidate stocks, liquidate the farmers, liquidate real estate. It will purge the rottenness out of the system." The result, according to the man of whom it was said three presidents served under him, the last being Herbert Hoover: "Values will be adjusted, and enterprising people will pick up from less competent people."

The Austrian prescription, of course, was rejected first by the New Deal of Franklin D. Roosevelt, and now by massive response by both the purportedly conservative Bush administration and now the Obama administration. First came the $700 billion TARP last year to stabilize the financial system, followed by the $787 billion fiscal stimulus enacted last month. Across party lines, it's accepted that government's role is to prevent the economic pain that would come of "liquidate, liquidate, liquidate."

http://online.barrons.com/article/SB123680667244600275.html

------------------------

Check out the rest of this blog here.

Wednesday 11 March 2009

AIG's Small London Office May Have Lost $500B

Ground zero for AIG's spectacular implosion, which has soaked up more federal bailout money than any other entity, appears to have been a small London branch office that may have lost nearly half a trillion dollars in bad deals.

The disastrous deals were built up in a decade and, when the crisis hit, the man who ran the unit for the last eight years retired after making $280 million for himself and leaving with a $1 million-a-month consulting contract.

more ...

------------------------

Check out the rest of this blog here.

Tuesday 10 March 2009

The Federal Reserve is Bankrupt

By way of analogy, if your high street bank’s balance sheet is made up of junk, what would you do? There are just not enough assets to meet its liabilities.

But of course, one can argue that the Fed is not your high street bank. It is the central bank of the mighty USA. It will always be able to "print money" or "digitalise" money and keep the markets going.

But beware that the Federal Reserve Note is mere paper, fiat money which cannot be redeemed for anything tangible such as gold. And although it is stated boldly in the notes issued - "In God we trust" - you and I are not actually placing our trust in God when accepting the Federal Reserve Notes as "money".

When Joe Six-Packs realises that the Federal Reserve Note is not even secured by US treasuries and or the FED has real tangible assets, but its balance sheet is littered with junks and toxic waste, there will be a run on the Fed i.e. when Americans and foreigners no longer have faith in the Federal Reserve Notes as "money".

If confidence could vaporise in a second and cause a stampede in what was once considered solid security, the triple A rated bonds in the repo and money markets, the same confidence that is now reposed in the Federal Reserve Notes can likewise disappear into the memory hole.

All these years, the con was maintained by the Fed that it was solid because it has on its balance sheet over $800 billion of US treasuries i.e. its notes "were so-called backed by these treasuries". It could sell its treasuries in the repo market for cash and thereby control the money flows in the economy and vice versa.

In their subconscious mind, Americans and stupid foreign central banks and their executives (brain-washed by the Chicago School of Economics) somehow believe in the infallibility of the Fed.

Now it has been exposed that the Fed’s "assets" comprise of junk bonds and toxic wastes.

The Emperor has no clothes!

http://www.globalresearch.ca/index.php?context=viewArticle&code=CHA20090310&articleId=12648

------------------------

Check out the rest of this blog here.

Whitney says credit cards are the next credit crunch

Prominent banking analyst Meredith Whitney warned that "credit cards are the next credit crunch," as contracting credit lines will lower consumer spending and hurt the U.S. economy.

"Few doubt the importance of consumer spending to the U.S. economy and its multiplier effect on the global economy, but what is underappreciated is the role of credit-card availability in that spending," Whitney wrote in the Wall Street Journal.

She said though credit was extended "too freely over the past 15 years" and rationalization of lending is unavoidable, what needs to be avoided was "taking credit away from people who have the ability to pay their bills."

more ...

------------------------

Check out the rest of this blog here.

"Few doubt the importance of consumer spending to the U.S. economy and its multiplier effect on the global economy, but what is underappreciated is the role of credit-card availability in that spending," Whitney wrote in the Wall Street Journal.

She said though credit was extended "too freely over the past 15 years" and rationalization of lending is unavoidable, what needs to be avoided was "taking credit away from people who have the ability to pay their bills."

more ...

------------------------

Check out the rest of this blog here.

$5,000/ounce gold a reasonable target ?

In a world where most investment classes are taking a knock, gold has been firmly on the way up. The way things are going, $5,000 an ounce (one troy ounce equals 31.1 grams) for the yellow metal maybe a reasonable target in a few years, says John Rubino, co-author of The Collapse of the Dollar and How to Profit From It, first published in 2003. The metal is currently quoting at $911 an ounce.

more ...

------------------------

Check out the rest of this blog here.

more ...

------------------------

Check out the rest of this blog here.

Monday 9 March 2009

13% Chance Buffett Is Going To Zero ???

http://www.businessinsider.com/13-chance-buffett-is-going-to-zero-2009-3

------------------------

Check out the rest of this blog here.

AIG is a killing machine, feed it money or else !

American International Group Inc. appealed for its fourth U.S. rescue by telling regulators the company’s collapse could cripple money-market funds, force European banks to raise capital, cause competing life insurers to fail and wipe out the taxpayers’ stake in the firm.

AIG needed immediate help from the Federal Reserve and Treasury to prevent a “catastrophic” collapse that would be worse for markets than the demise last year of Lehman Brothers Holdings Inc., according to a 21-page draft AIG presentation dated Feb. 26, labeled as “strictly confidential” and circulated among federal and state regulators.

“What happens to AIG has the potential to trigger a cascading set of further failures which cannot be stopped except by extraordinary means,” said the presentation by New York- based AIG. “Insurance is the oxygen of the free enterprise system. Without the promise of protection against life’s adversities, the fundamentals of capitalism are undermined.”

more ...

------------------------

Check out the rest of this blog here.

AIG needed immediate help from the Federal Reserve and Treasury to prevent a “catastrophic” collapse that would be worse for markets than the demise last year of Lehman Brothers Holdings Inc., according to a 21-page draft AIG presentation dated Feb. 26, labeled as “strictly confidential” and circulated among federal and state regulators.

“What happens to AIG has the potential to trigger a cascading set of further failures which cannot be stopped except by extraordinary means,” said the presentation by New York- based AIG. “Insurance is the oxygen of the free enterprise system. Without the promise of protection against life’s adversities, the fundamentals of capitalism are undermined.”

more ...

------------------------

Check out the rest of this blog here.

Skyscrapers and Business Cycles

The skyscraper index, created by economist Andrew Lawrence shows a correlation between the construction of the world's tallest building and the business cycle. Is this just a coincidence, or perhaps do skyscrapers cause business cycles? A theoretical foundation of "Cantillon effects" for the skyscraper index is provided here showing how the basic components of skyscraper construction such as technology are related to key theoretical concepts in economics such as the structure of production. The findings, empirical and theoretical, suggest that the business-cycle theory of the Austrian School of economics has much to contribute to our understanding of business cycles, particularly severe ones.

http://mises.org/story/3038

------------------------

Check out the rest of this blog here.

Sunday 8 March 2009

CNBC Gives Financial Advice

The Daily Show With Jon StewartM - Th 11p / 10c

------------------------

Check out the rest of this blog here.

'Run on UK' sees foreign investors pull $1 trillion out of the City

A silent $1 trillion "Run on Britain" by foreign investors was revealed yesterday in the latest statistical releases from the Bank of England. The external liabilities of banks operating in the UK – that is monies held in the UK on behalf of foreign investors – fell by $1 trillion (£700bn) between the spring and the end of 2008, representing a huge loss of funds and of confidence in the City of London.

Some $597.5bn was lost to the banks in the last quarter of last year alone, after a modest positive inflow in the summer, but a massive $682.5bn haemorrhaged in the second quarter of 2008 – a record. About 15 per cent of the monies held by foreigners in the UK were withdrawn over the period, leaving about $6 trillion. This is by far the largest withdrawal of foreign funds from the UK in recent decades – about 10 times what might flow out during a "normal" quarter.

The revelation will fuel fears that the UK's reputation as a safe place to hold funds is being fatally comp-romised by the acute crisis in the banking system and a general trend to financial protectionism internat- ionally. This week, Lloyds became the latest bank to approach the Government for more assistance. A deal was agreed last night for the Government to insure about £260bn of assets in return for a stake of up to 75 per cent in the bank. The slide in sterling – it has shed a quarter of its value since mid-2007 – has been both cause and effect of the run on London, seemingly becoming a self-fulfilling phenomenon. The danger is that the heavy depreciation of the pound could become a rout if confidence completely evaporates.

Colin Ellis, an economist at Daiwa Securities, commented: "The outflow of overseas banks' UK holdings is not surprising – indeed foreign investors in general will still be smarting from the sharp fall in the exchange rate last year, as many UK liabilities are priced in sterling terms. That raises the question of what could possibly tempt overseas investors to return to the UK. Further heavy outflows of funds are probably a given."

The Bank of England said that there had been a large fall in deposits from the United States, Switzerland, offshore centres such as Jersey and the Cayman Islands, and from Russia.

Paranoia that the UK could follow Iceland into effective national insolvency and jibes about "Reykjavik on Thames" will find an unwelcome substantiation in these statistics – which also show that stricken British banks are having to repatriate similar sums back to Britain. This is scant consolation for the authorities, however, as it means the UK and sterling are, like some emerging markets and currencies, suffering from a flight of capital. By contrast some financial centres and currencies – notably the US dollar and the Swiss franc – are enjoying a boost as "safe havens" in a troubled world.

more ...

------------------------

Check out the rest of this blog here.

Some $597.5bn was lost to the banks in the last quarter of last year alone, after a modest positive inflow in the summer, but a massive $682.5bn haemorrhaged in the second quarter of 2008 – a record. About 15 per cent of the monies held by foreigners in the UK were withdrawn over the period, leaving about $6 trillion. This is by far the largest withdrawal of foreign funds from the UK in recent decades – about 10 times what might flow out during a "normal" quarter.

The revelation will fuel fears that the UK's reputation as a safe place to hold funds is being fatally comp-romised by the acute crisis in the banking system and a general trend to financial protectionism internat- ionally. This week, Lloyds became the latest bank to approach the Government for more assistance. A deal was agreed last night for the Government to insure about £260bn of assets in return for a stake of up to 75 per cent in the bank. The slide in sterling – it has shed a quarter of its value since mid-2007 – has been both cause and effect of the run on London, seemingly becoming a self-fulfilling phenomenon. The danger is that the heavy depreciation of the pound could become a rout if confidence completely evaporates.

Colin Ellis, an economist at Daiwa Securities, commented: "The outflow of overseas banks' UK holdings is not surprising – indeed foreign investors in general will still be smarting from the sharp fall in the exchange rate last year, as many UK liabilities are priced in sterling terms. That raises the question of what could possibly tempt overseas investors to return to the UK. Further heavy outflows of funds are probably a given."

The Bank of England said that there had been a large fall in deposits from the United States, Switzerland, offshore centres such as Jersey and the Cayman Islands, and from Russia.

Paranoia that the UK could follow Iceland into effective national insolvency and jibes about "Reykjavik on Thames" will find an unwelcome substantiation in these statistics – which also show that stricken British banks are having to repatriate similar sums back to Britain. This is scant consolation for the authorities, however, as it means the UK and sterling are, like some emerging markets and currencies, suffering from a flight of capital. By contrast some financial centres and currencies – notably the US dollar and the Swiss franc – are enjoying a boost as "safe havens" in a troubled world.

more ...

------------------------

Check out the rest of this blog here.

Saturday 7 March 2009

If Goldman Sachs isn't a conspiracy what is ???

As it was in the beginning, so shall it be in the end: Goldman Sachs will be there.

Back in the '90s and through the mid-'00s, major figures from Goldman Sachs such as Robert Rubin, Gary Gensler and Hank Paulson stood fast against derivatives regulation (Rubin and Gensler) and lobbied successfully for higher leverage ratios so they could bet more of their capital on the market boom (Paulson). When those policies came to grief and Wall Street imploded, and the Feds scrambled to rescue stricken insurance giant AIG, Goldman CEO Lloyd Blankfein was reportedly the only bank executive invited to an emergency meeting at the New York Federal Reserve (convened by then-Fed president Tim Geithner).

Now Treasury Secretary Geithner—a Rubin protégé, of course—has assigned two more ex-Goldman men to fix the vast mess their colleagues helped to create.

more ...

------------------------

Check out the rest of this blog here.

Back in the '90s and through the mid-'00s, major figures from Goldman Sachs such as Robert Rubin, Gary Gensler and Hank Paulson stood fast against derivatives regulation (Rubin and Gensler) and lobbied successfully for higher leverage ratios so they could bet more of their capital on the market boom (Paulson). When those policies came to grief and Wall Street imploded, and the Feds scrambled to rescue stricken insurance giant AIG, Goldman CEO Lloyd Blankfein was reportedly the only bank executive invited to an emergency meeting at the New York Federal Reserve (convened by then-Fed president Tim Geithner).

Now Treasury Secretary Geithner—a Rubin protégé, of course—has assigned two more ex-Goldman men to fix the vast mess their colleagues helped to create.

more ...

------------------------

Check out the rest of this blog here.

UK Government bonds are in a bubble so the Bank of England prints money to buy them and push prices up even more ???

U.K. 10-year gilts posted the biggest weekly gain since 1992 after the Bank of England said it plans to buy medium- and long-maturity bonds to inject cash into the struggling economy.

The increase pushed the 10-year yield to its largest two-day decline the past two days since Bloomberg records began in 1989. The central bank cut the main interest rate to 0.50 percent on March 5 and said it plans to spend 75 billion pounds ($106 billion) on government and corporate bonds over the next three months. The difference in yield between two- and 10-year notes narrowed to the least in almost two months on speculation rate cuts are at an end.

“Longer-dated bonds jumped and outperformed because the market was caught off guard, thinking the Bank of England would focus on shorter maturities,” said Matteo Regesta, an interest- rate strategist in London at BNP Paribas SA. “The Bank of England signaled the rate has reached its trough, and I expect the two-, 10-year spread to narrow further.”

http://www.bloomberg.com/apps/news?pid=20601102&sid=auCcFMGnBhtE&refer=uk

------------------------

Check out the rest of this blog here.

Friday 6 March 2009

Amazing Similarities in Dow Jones 1937 and Today: 60% rally near ?

http://blog.afraidtotrade.com/amazing-similarities-in-dow-jones-1937-and-today/

------------------------

Check out the rest of this blog here.

Gold Chart: Still in strong uptrend

http://blog.afraidtotrade.com/a-midweek-look-at-gold-daily-chart/

------------------------

Check out the rest of this blog here.

Banana Republic, U.S.A

F. A. Hayek won the Nobel Prize in 1974 for showing how central bank manipulation of interest rates gives rise to the kind of boom-bust cycle we are experiencing now, and that such phenomena are not caused by the unhampered market. If by some miracle you manage to hear this point of view on television, it will be sandwiched between hours and hours of Keynesian droning.

Of course, the rationale we’re being given for the insanity is that these are crisis times, and the usual rules go out the window. That’s what Paul Krugman means when he speaks of “depression economics”—a special set of economic principles come into play in times like this that differ radically from those we would abide by under normal conditions. And so we see once again why Keynesian economics swept the board so successfully: it tells the regime just what it wants to hear. It provides intellectual cover for the expansion of government power and the seizure of private property that state officials want to engage in anyway.

http://www.firstprinciplesjournal.com/articles.aspx?article=1223&theme=home&page=1&loc=b&type=cttf

------------------------

Check out the rest of this blog here.

Thursday 5 March 2009

Wednesday 4 March 2009

Milton Friedman was right to predict that the euro might not survive a recession

When Ferenc Gyurcsany, the Hungarian prime minister, asked them for a €190 billion handout last weekend to prevent a new economic Iron Curtain from going up across the continent, Angela Merkel told him to get lost. She has the German people and, more to the point, German business behind her: why should they pay for the unregenerate behaviour of others? Why should they worry about the collapse of the zloty and the forint? Why should it bother them that Latvia's debt now has junk rating, or that the Irish are almost broke? If Mrs Merkel wants to stay in power, and German workers wish to keep the fruits of their own labours, they must harden their hearts.

As for the rest of Europe, it must choose either to devalue and end the pretence of economic strength, or persist and risk the breakdown of individual governments. Either way, it is never glad confident morning again for the EU and its bastard currency. Milton was right.

http://www.telegraph.co.uk/comment/columnists/simonheffer/4934431/Its-the-Europhiles-versus-reality-and-reality-is-going-to-win.html

------------------------

Check out the rest of this blog here.

Juno's Temple - part 1 of 6 - The Creation of Money

Part 1 of 6, The Creation of Money: Where does money come from? It's created out of thin air from the both Fed and the banking system! See and hear MANY clips from mainstream media such as NPR, Associated Press, and the Wallstreet Journal admitting as much, as well as Fed officials and noted economists confirming it. It may seem like an overdose, but most people don't understand how money is created, so by the end, anybody new to the subject will have no doubt that money is created out of thin air, and those who are not new to the subject have plenty of new sources they can refer to instead of just quoting Ron Paul, who isn't even in this video. And Part I ends with a scary clip of just how much money has been created as of late and what the consequences might be.

http://blip.tv/file/1800745/

http://emazur.blip.tv/posts?view=archive&nsfw=dc

------------------------

Check out the rest of this blog here.

Tuesday 3 March 2009

Jim Rogers: Let AIG Go Bankrupt, Not America

"Power is shifting now from the money shifters, the guys who trade paper and money, to people who produce real goods. What you should do is become a farmer, or start a farming network," Rogers said.

http://www.cnbc.com/id/29476319

------------------------

Check out the rest of this blog here.

http://www.cnbc.com/id/29476319

------------------------

Check out the rest of this blog here.

Monday 2 March 2009

Warren Buffett, long revered for his investment prowess, has admitted that even he made some "dumb" mistakes during the past year

In his annual letter to investors in his company Berkshire Hathaway, he said the errors included buying stakes in two Irish banks.

He also regretted investing in oil company Conoco Philips when the crude price was at its peak.

Berkshire's profits fell 62% in 2008 - the worst performance in its 44 years.

The company's net earnings totalled $4.99bn (£3.5bn) in 2008 compared with $13.2bn in 2007.

more ...

------------------------

Check out the rest of this blog here.

Sunday 1 March 2009

Maria Bartiromo talks to global investor Jim Rogers

MARIA BARTIROMO

What do you think of the government's response to the economic crisis?

JIM ROGERS

Terrible. They're making it worse. It's pretty embarrassing for President Obama, who doesn't seem to have a clue what's going on—which would make sense from his background. And he has hired people who are part of the problem. [Treasury Secretary Tim] Geithner was head of the New York Fed, which was supposedly in charge of Wall Street and the banks more than anybody else. And as you remember, [Obama's chief economic adviser, Larry] Summers helped bail out Long-Term Capital Management years ago. These are people who think the only solution is to save their friends on Wall Street rather than to save 300 million Americans.

more ...

------------------------

Check out the rest of this blog here.

Subscribe to:

Posts (Atom)