The news comes after the Council for Mortgage Lenders forecast that the number of repossessions is likely nearly to double to 75,000 next year.

A YouGov poll, carried out for a new report from Tory MP Grant Shapps, found that 44 per cent of mortgage holders are worried that lenders could force them out of their properties next year.

A similar proportion were worried about not being able to meet mortgage payments between now and the end of 2010.

The study - The New Homeless - found that the concern among homeowners about losing the roof over their heads in the economic downturn stretched across society

more ...

------------------------

Check out the rest of this blog here.

I started this blog in June 2007 asking these questions: Are we in a massive asset bubble that will blow up in our faces ??? - ANSWERED YES ! Is western and particularly British society on the verge of social collapse??? What are the best common sense long term investment strategies to keep you rich? When will consumption/debt bubble economics end and a real savings/production economy begin ???

Wednesday 31 December 2008

Peter Schiff interview from May 2002 - Austrians know how to price stuff and thus are not fooled by bubbles and inflation

http://www.powerset.com/explore/semhtml/Peter_Schiff?query=Peter+Schiff

http://www.powerset.com/explore/semhtml/Austrian_School

------------------------

Check out the rest of this blog here.

Sir Evelyn de Rothschild on CNBC Dec 10, 2008

http://www.powerset.com/explore/semhtml/Evelyn_Robert_de_Rothschild?query=Sir+Evelyn+de+Rothschild

http://www.powerset.com/explore/semhtml/Rothschild_banking_family_of_England

------------------------

Check out the rest of this blog here.

Tuesday 30 December 2008

Russian Professor Predicts End of U.S.

MOSCOW -- For a decade, Russian academic Igor Panarin has been predicting the U.S. will fall apart in 2010. For most of that time, he admits, few took his argument -- that an economic and moral collapse will trigger a civil war and the eventual breakup of the U.S. -- very seriously. Now he's found an eager audience: Russian state media.

In recent weeks, he's been interviewed as much as twice a day about his predictions. "It's a record," says Prof. Panarin. "But I think the attention is going to grow even stronger."

Prof. Panarin, 50 years old, is not a fringe figure. A former KGB analyst, he is dean of the Russian Foreign Ministry's academy for future diplomats. He is invited to Kremlin receptions, lectures students, publishes books, and appears in the media as an expert on U.S.-Russia relations.

But it's his bleak forecast for the U.S. that is music to the ears of the Kremlin, which in recent years has blamed Washington for everything from instability in the Middle East to the global financial crisis. Mr. Panarin's views also fit neatly with the Kremlin's narrative that Russia is returning to its rightful place on the world stage after the weakness of the 1990s, when many feared that the country would go economically and politically bankrupt and break into separate territories.

more ...

------------------------

Check out the rest of this blog here.

Was the 'Credit Crunch' a Myth Used to Sell a Trillion-Dollar Scam?

There is something approaching a consensus that the Paulson Plan -- also known as the Troubled Asset Relief Program, or TARP -- was a boondoggle of an intervention that's flailed from one approach to the next, with little oversight and less effect on the financial meltdown.

But perhaps even more troubling than the ad hoc nature of its implementation is the suspicion that has recently emerged that TARP -- hundreds of billions of dollars worth so far -- was sold to Congress and the public based on a Big Lie.

President George W. Bush, fabulist-in-chief, articulated the rationale for the program in that trademark way of his -- as if addressing a nation of slow-witted 12-year-olds -- on Sept. 24: "Major financial institutions have teetered on the edge of collapse ... [and] began holding onto their money, and lending dried up, and the gears of the American financial system began grinding to a halt." Bush said that if Congress didn't give Treasury Secretary Hank Paulson the trillion dollars (give or take) for which he was asking, the results would be disastrous: "Even if you have good credit history, it would be more difficult for you to get the loans you need to buy a car or send your children to college. And ultimately, our country could experience a long and painful recession."

For the most part, the press has continued to echo Bush's central assertion that there's a "credit crunch" preventing even qualified borrowers -- that's the key point -- from getting loans, and it's now part of the conventional wisdom.

more ...

------------------------

Check out the rest of this blog here.

But perhaps even more troubling than the ad hoc nature of its implementation is the suspicion that has recently emerged that TARP -- hundreds of billions of dollars worth so far -- was sold to Congress and the public based on a Big Lie.

President George W. Bush, fabulist-in-chief, articulated the rationale for the program in that trademark way of his -- as if addressing a nation of slow-witted 12-year-olds -- on Sept. 24: "Major financial institutions have teetered on the edge of collapse ... [and] began holding onto their money, and lending dried up, and the gears of the American financial system began grinding to a halt." Bush said that if Congress didn't give Treasury Secretary Hank Paulson the trillion dollars (give or take) for which he was asking, the results would be disastrous: "Even if you have good credit history, it would be more difficult for you to get the loans you need to buy a car or send your children to college. And ultimately, our country could experience a long and painful recession."

For the most part, the press has continued to echo Bush's central assertion that there's a "credit crunch" preventing even qualified borrowers -- that's the key point -- from getting loans, and it's now part of the conventional wisdom.

more ...

------------------------

Check out the rest of this blog here.

The Disciplined Investor with Peter Schiff

Andrew and Peter explore the global meltdown and the potential winners emerging out of the ashes. How has his theory of a global market decoupling performed for his investment clients during 2008?

http://www.thedisciplinedinvestor.com/blog/2008/12/30/tdi-episode-89-crashproofn-with-peter-schiff/

http://feeds.feedburner.com/~r/thedisciplinedinvestor/EBHR/~5/498619627/tdi_episode89.mp3

------------------------

Check out the rest of this blog here.

Monday 29 December 2008

140,000 uk families are living on handouts worth in excess of £20,000 a year

An astonishing 140,000 households are pocketing more in benefits than the average take-home wage.

The families are living on handouts worth in excess of £20,000 a year, official figures show.

The enormous payouts dwarf the incomes of millions of hard-working families who are struggling to cope with the recession and the rising cost of living.

The average salary is £25,100 before tax, but after deductions it shrinks to £19,126. In contrast, state benefits are tax-free.

A worker would have to earn £27,000 a year to take home more than £20,000.

more ...

------------------------

Check out the rest of this blog here.

The families are living on handouts worth in excess of £20,000 a year, official figures show.

The enormous payouts dwarf the incomes of millions of hard-working families who are struggling to cope with the recession and the rising cost of living.

The average salary is £25,100 before tax, but after deductions it shrinks to £19,126. In contrast, state benefits are tax-free.

A worker would have to earn £27,000 a year to take home more than £20,000.

more ...

------------------------

Check out the rest of this blog here.

Sunday 28 December 2008

Gordon Brown is using the recession to test the character of the British people but the church thinks he is morally corrupt !

In next week's New Year message, the prime minister is expected to urge the public to "display the same spirit" as their predecessors did in World War II.

He will also describe US president-elect Barack Obama as a "catalyst" for tackling global issues.

And Mr Brown will demand that the public work together in an effort to build a "better tomorrow".

http://news.bbc.co.uk/1/hi/uk_politics/7801665.stm

Five Anglican bishops have attacked the government by calling into question the morality of its policies.

The bishops of Durham, Winchester, Hulme, Manchester and Carlisle told the Sunday Telegraph the UK was beset by family breakdown, debt and poverty.

Bishop of Manchester the Rt Rev Nigel McCulloch said Labour was "beguiled by money" and "morally corrupt".

http://news.bbc.co.uk/1/hi/uk/7801667.stm

------------------------

Check out the rest of this blog here.

Man-made global warming just a joke propagated by the BBC and scientists paid to produce warming computer simulations ?

The first, on May 21, headed "Climate change threat to Alpine ski resorts" , reported that the entire Alpine "winter sports industry" could soon "grind to a halt for lack of snow". The second, on December 19, headed "The Alps have best snow conditions in a generation" , reported that this winter's Alpine snowfalls "look set to beat all records by New Year's Day".

Easily one of the most important stories of 2008 has been all the evidence suggesting that this may be looked back on as the year when there was a turning point in the great worldwide panic over man-made global warming. Just when politicians in Europe and America have been adopting the most costly and damaging measures politicians have ever proposed, to combat this supposed menace, the tide has turned in three significant respects.

First, all over the world, temperatures have been dropping in a way wholly unpredicted by all those computer models which have been used as the main drivers of the scare. Last winter, as temperatures plummeted, many parts of the world had snowfalls on a scale not seen for decades. This winter, with the whole of Canada and half the US under snow, looks likely to be even worse. After several years flatlining, global temperatures have dropped sharply enough to cancel out much of their net rise in the 20th century.

more ...

------------------------

Check out the rest of this blog here.

Saturday 27 December 2008

We knew about the 'crazy' mortgages, but Bank of England admits it failed to grasp scale of crisis

He admitted there is a risk that billions of pounds will be lost by the two embattled banks.

Perhaps more worrying, he said the bank's base interest rate, recently slashed in an attempt to kickstart borrowing, was a 'blunt instrument' - and new tools were needed to help steer Britain through the crisis.

New 'policy instruments' were being discussed, which would 'make it expensive for banks to expand rapidly in the upswing', he said.

http://www.dailymail.co.uk/news/article-1099662/We-saw-crazy-mortgages-failed-spot-dangers-debt-Bank-chiefs-startling-admission-financial-crisis.html

------------------------

Check out the rest of this blog here.

BBC Panorama: The Year Britain's Bubble Burst

It has been a cataclysmic year for our banks and economy, and a year in which the role of the BBC's Business Editor has been in the spotlight as never before.

With exclusive interviews with the major players, Robert Peston reflects on how these momentous events will affect us all.

http://www.bbc.co.uk/programmes/b00gbds9

Spend a few minutes with the BBC's Business Editor Robert Peston, as he explains why we are in the middle of a global financial crisis.

http://news.bbc.co.uk/1/hi/business/7688308.stm

------------------------

Check out the rest of this blog here.

With exclusive interviews with the major players, Robert Peston reflects on how these momentous events will affect us all.

http://www.bbc.co.uk/programmes/b00gbds9

Spend a few minutes with the BBC's Business Editor Robert Peston, as he explains why we are in the middle of a global financial crisis.

http://news.bbc.co.uk/1/hi/business/7688308.stm

------------------------

Check out the rest of this blog here.

Madoff: How Do You Steal $50 Billion Dollars?

Bernard Madoff, president of the Bernard L. Madoff Investment Securities financial advisory firm, was arrested by FBI agents and later charged with securities fraud on December 11, 2008. The charges stem from Madoff's alleged involvement in a Ponzi scheme in which investors lost an estimated $50 billion.

On December 17, 2008, Madoff was released on bond. The judge gave him a curfew and issued him a monitoring bracelet. Madoff will be confined to his $7 million Park Avenue apartment. Madoff had to sign over his Upper East Side apartment and homes in Palm Beach and the Hamptons to make the $10 million bond.

Madoff's Money Trail Leads to Washington

http://www.counterpunch.org/martens12222008.html#

http://www.mahalo.com/Bernard_Madoff

------------------------

Check out the rest of this blog here.

On December 17, 2008, Madoff was released on bond. The judge gave him a curfew and issued him a monitoring bracelet. Madoff will be confined to his $7 million Park Avenue apartment. Madoff had to sign over his Upper East Side apartment and homes in Palm Beach and the Hamptons to make the $10 million bond.

Madoff's Money Trail Leads to Washington

Naturally, the Madoff money trail of special favors and exceptions leads straight to Washington. From 1998 through 2008, Bernard L. Madoff Investment Securities paid $590,000 lobbying Congress and the SEC, according to the Center for Responsive Politics. His lobby firm for most of those years was Lent, Scrivner & Roth, with Norman F. Lent III signing the disclosure documents in the House and Senate. One of Madoff’s hot button issues during those years according to the disclosure documents was getting a single regulator. That meant, for starters, merging those prying eyes over at the New York Stock Exchange into the clubby pool of self-regulators at the National Association of Securities Dealers where the Madoff family held numerous seats of power. That wish came true when NASD Regulation merged with the enforcement and arbitration units of the New York Stock Exchange in July 2007 to create the Financial Industry Regulatory Authority (FINRA).

http://www.counterpunch.org/martens12222008.html#

http://www.mahalo.com/Bernard_Madoff

------------------------

Check out the rest of this blog here.

The UK economy will shrink by 2.9% in 2009 - more than at any time since the 1940s

A stark picture of the prospects for the UK economy has been painted by an independent group of economists.

The Centre for Economics and Business Research (CEBR) predicts the economy will shrink by 2.9% in 2009 - more than at any time since the 1940s.

It expects consumer spending to decline and investment in business to slump.

The forecasters say exporters will be helped by the slump in the pound's value, but even their prospects will be held back by a global slowdown.

more ...

http://news.bbc.co.uk/1/hi/business/7796960.stm

------------------------

Check out the rest of this blog here.

The Centre for Economics and Business Research (CEBR) predicts the economy will shrink by 2.9% in 2009 - more than at any time since the 1940s.

It expects consumer spending to decline and investment in business to slump.

The forecasters say exporters will be helped by the slump in the pound's value, but even their prospects will be held back by a global slowdown.

more ...

http://news.bbc.co.uk/1/hi/business/7796960.stm

------------------------

Check out the rest of this blog here.

Tuesday 23 December 2008

Warren E. Buffett, the world’s greatest investor

What Everybody Ought To Know About Warren Buffett - Episode #31 from The Way To Build Wealth on Vimeo.

------------------------

Check out the rest of this blog here.

The Ludwig von Mises Institute

The Ludwig von Mises Institute is the research and educational center of classical liberalism, libertarian political theory, and the Austrian School of economics. Working in the intellectual tradition of Ludwig von Mises (1881-1973) and Murray N. Rothbard (1926-1995), with a vast array of publications, programs, and fellowships, the Mises Institute, with offices in Auburn, Alabama, seeks a radical shift in the intellectual climate as the foundation for a renewal of the free and prosperous commonwealth.

http://mises.org/about.aspx

The future of the dollar (1996):

http://mises.org/multimedia/mp3/Freedom96/03_Freedom_Salerno.mp3

------------------------

Check out the rest of this blog here.

Thursday 18 December 2008

Sign of the times: about 1,000 apply to burger joint for 50 jobs

Some wore ties. Some wore their pants too low. Some were balding. Some owed two months of mortgage payments. Some spoke openly of suicide. Some asked this reporter for a job. Some asked the manager at the hotel hosting the event for a job.

Ahead of a new In-N-Out restaurant opening in Las Vegas, close to 1,000 applied for a $10-an-hour job flipping or serving burgers. There are 50 available jobs, at most.

Sharell Hewlett, who will be one of the managers of the new restaurant and had the frontline job of handing out applications, said she found the range of applicants, from teens to retirement age, "incredible."

There was 42-year-old Freda Beckwith, who Wednesday observes three months of joblessness. Her resume ends at the Bellagio, where she was a cashier until Sept. 17, when she and 14 others in her department were stripped of their jobs.

more ...

------------------------

Check out the rest of this blog here.

Ahead of a new In-N-Out restaurant opening in Las Vegas, close to 1,000 applied for a $10-an-hour job flipping or serving burgers. There are 50 available jobs, at most.

Sharell Hewlett, who will be one of the managers of the new restaurant and had the frontline job of handing out applications, said she found the range of applicants, from teens to retirement age, "incredible."

There was 42-year-old Freda Beckwith, who Wednesday observes three months of joblessness. Her resume ends at the Bellagio, where she was a cashier until Sept. 17, when she and 14 others in her department were stripped of their jobs.

more ...

------------------------

Check out the rest of this blog here.

Wednesday 17 December 2008

From pension blunder to Sats debacle, oversized Whitehall bureaucracy wreaks havoc. But those with power cling to it

Organising an examination for Britain's teenagers should not be too tough a job. For half a century, local government managed it. Yet from the moment testing was nationalised under the Tories it went berserk. Ministers floundered, claiming to "need to know" everything about the nation's young. In the decade from its introduction by John Patten in 1993, the cost of testing and league tables rose from £10m to £610m. Each July saw a flood of "exam fiasco" stories. Nobody could agree over standards. A secretary of state - Estelle Morris - resigned, and officials and private companies came, went, resigned or were sacked.

Last summer the testing regime reached its nadir. Nobody had been found in all Britain up to the task of running an attainment test for 14-year-olds. The "market price" for such a paragon was eventually fixed at a salary of £328,000, a flat in west London, membership of a yacht club in Sydney harbour and six club-class tickets round the world. This obscene reward went to an Australian, Ken Boston, who proved unable to do the job without spending a further £156m on an American company, ETS (Educational Testing Services). In July hundreds of thousands of exam papers were delayed or improperly marked, and another fiasco was declared as such by Lord Sutherland in his Sats inquiry report last night.

Exams are not alone. Yesterday's newspapers contained tales of woe from the following corners of the public sector: a pensions overpayment, a BBC audience voting farce, a transport department efficiency scam and a knife-crime statistics shocker. Only the ID card and NHS computer shambles disappeared briefly from the spotlight.

more ...

------------------------

Check out the rest of this blog here.

Last summer the testing regime reached its nadir. Nobody had been found in all Britain up to the task of running an attainment test for 14-year-olds. The "market price" for such a paragon was eventually fixed at a salary of £328,000, a flat in west London, membership of a yacht club in Sydney harbour and six club-class tickets round the world. This obscene reward went to an Australian, Ken Boston, who proved unable to do the job without spending a further £156m on an American company, ETS (Educational Testing Services). In July hundreds of thousands of exam papers were delayed or improperly marked, and another fiasco was declared as such by Lord Sutherland in his Sats inquiry report last night.

Exams are not alone. Yesterday's newspapers contained tales of woe from the following corners of the public sector: a pensions overpayment, a BBC audience voting farce, a transport department efficiency scam and a knife-crime statistics shocker. Only the ID card and NHS computer shambles disappeared briefly from the spotlight.

more ...

------------------------

Check out the rest of this blog here.

Saturday 13 December 2008

Friday 12 December 2008

America Has No Means to Recover from a Depression

Speaking in front of members of Congress on Tuesday, economist Peter Morici, a professor at the University of Maryland, said the job loss experienced in November "was much worse than was expected ... The threat of a widespread depression is now real and present."

Many economic observers have justifiably stated that the U.S. is in the midst of the greatest recession facing the nation since the Great Depression. On Monday, the National Bureau of Economic Research finally acknowledged what most of Americans have known for some time: that the U.S. is officially in a deep and painful recession. Few, if any, however, will dare to call the current downturn a Depression. Actually, the department responsible for categorizing our economic condition, NEBR, refuses to use the term, although most Americans, judging by what they see and what is happening to them, realize we are truly entering a depression.

more ...

------------------------

Check out the rest of this blog here.

Many economic observers have justifiably stated that the U.S. is in the midst of the greatest recession facing the nation since the Great Depression. On Monday, the National Bureau of Economic Research finally acknowledged what most of Americans have known for some time: that the U.S. is officially in a deep and painful recession. Few, if any, however, will dare to call the current downturn a Depression. Actually, the department responsible for categorizing our economic condition, NEBR, refuses to use the term, although most Americans, judging by what they see and what is happening to them, realize we are truly entering a depression.

more ...

------------------------

Check out the rest of this blog here.

More than 22,000 people are chasing 500 "high flyer" jobs in Whitehall

More than 22,000 people are chasing 500 "high flyer" jobs in Whitehall as the credit crunch leads bright young graduates to spurn business for a job in government.

Sir Gus O'Donnell, the cabinet secretary, will tell MPs today that there has been a 33% rise in the number of people wanting to join the fast stream of the civil service.

These are the people who take jobs in ministers' private offices and are trained to be the next generation of senior civil servants who will formulate policy and run big government agencies.

The competition for top jobs in Whitehall has increased dramatically because of job insecurity in private business, Sir Gus will tell the Commons public administration committee. He will say that the civil service is now attracting applications from young redundant bankers following the collapse of Lehman Brothers and staff cuts at other City firms.

more ...

------------------------

Check out the rest of this blog here.

Sir Gus O'Donnell, the cabinet secretary, will tell MPs today that there has been a 33% rise in the number of people wanting to join the fast stream of the civil service.

These are the people who take jobs in ministers' private offices and are trained to be the next generation of senior civil servants who will formulate policy and run big government agencies.

The competition for top jobs in Whitehall has increased dramatically because of job insecurity in private business, Sir Gus will tell the Commons public administration committee. He will say that the civil service is now attracting applications from young redundant bankers following the collapse of Lehman Brothers and staff cuts at other City firms.

more ...

------------------------

Check out the rest of this blog here.

Wednesday 10 December 2008

-50% for 2008. If this isn't a buy signal what is ?

This is a graphic of the Standard and Poor's stock index's annual returns, placing every year since 1825 in a column of returns from -50% to +60%.

------------------------

Check out the rest of this blog here.

------------------------

Check out the rest of this blog here.

Monday 8 December 2008

Friday 5 December 2008

US job losses reach 34-year high, World economy 'weakest since 30s', UK House prices still falling fast

US employers axed 533,000 jobs in November, the biggest monthly cut in 34 years, the US Labor Department said.

http://news.bbc.co.uk/1/hi/business/7767326.stm

The United Nations says the world economy faces its worst downturn since the Great Depression.

http://news.bbc.co.uk/1/hi/business/7757506.stm

House prices fell another 2.6% in November, the Halifax says.

http://news.bbc.co.uk/1/hi/business/7764272.stm

------------------------

Check out the rest of this blog here.

http://news.bbc.co.uk/1/hi/business/7767326.stm

The United Nations says the world economy faces its worst downturn since the Great Depression.

http://news.bbc.co.uk/1/hi/business/7757506.stm

House prices fell another 2.6% in November, the Halifax says.

http://news.bbc.co.uk/1/hi/business/7764272.stm

------------------------

Check out the rest of this blog here.

Sell The Rallies, says Nassim Taleb

http://www.1440wallstreet.com/index.php/site/comments/sell_the_rallies_says_nassim_taleb/

------------------------

Check out the rest of this blog here.

Thursday 4 December 2008

Don't Bail Out the US Housing Market - Martin Wolf

Financial journalist Martin Wolf argues against any proposed government "bailout" of the U.S. housing market.

------------------------

Check out the rest of this blog here.

------------------------

Check out the rest of this blog here.

The World's Worst Banker?

In the past couple of years, the entire global lending industry has covered itself in shame. Virtually every banker was suckered by the credit and housing bubble. But who made the sorriest choices? Who forced shareholders and the public to bear the highest financial cost? Who, in short, is the Worst Banker in the World?

There's no dearth of candidates. Richard Fuld of Lehman Bros. and James Cayne of Bear Stearns presided over the remarkably disruptive failures of their respective firms. But Bear and Lehman weren't banks, properly speaking: They were hedge funds lashed to investment banks. And their demises didn't require much of a public bailout. The failures of AIG, Fannie Mae, and Freddie Mac necessitated massive bailouts, but they weren't exactly banks, either. Iceland's bankers have effectively brought their entire country to ruin. But since Iceland's population is a mere 300,000, they're off the hook. In an interview Monday, Nobel laureate Paul Krugman nominated the gang that ran Citigroup into the ground. But Citi was so big it took three CEOs—Sandy Weill, Chuck Prince, and Vikram Pandit—to bring it to the brink of disaster.

more ...

------------------------

Check out the rest of this blog here.

There's no dearth of candidates. Richard Fuld of Lehman Bros. and James Cayne of Bear Stearns presided over the remarkably disruptive failures of their respective firms. But Bear and Lehman weren't banks, properly speaking: They were hedge funds lashed to investment banks. And their demises didn't require much of a public bailout. The failures of AIG, Fannie Mae, and Freddie Mac necessitated massive bailouts, but they weren't exactly banks, either. Iceland's bankers have effectively brought their entire country to ruin. But since Iceland's population is a mere 300,000, they're off the hook. In an interview Monday, Nobel laureate Paul Krugman nominated the gang that ran Citigroup into the ground. But Citi was so big it took three CEOs—Sandy Weill, Chuck Prince, and Vikram Pandit—to bring it to the brink of disaster.

more ...

------------------------

Check out the rest of this blog here.

Monday 1 December 2008

Krugman on the housing bubble and deficits

http://www.nytimes.com/2008/12/01/opinion/01krugman.html?_r=1&partner=permalink&exprod=permalink

------------------------

Check out the rest of this blog here.

Sunday 30 November 2008

Is Dubai is the world's biggest toxic timebomb ?

All questions about how this growth is being financed have been brushed aside. While the West has suffered, Dubai's extravagance has reached new levels: from its vast Terminal 3 at the international airport, which is due to be redundant when the even bigger Jabel Ali airport is built in 2015, to the $20m launch party of the Atlantis hotel two weeks ago.

But in recent weeks the cracks in Dubai's economy have become undeniable. Property prices have slumped, demand has dried up and, for the first time, the emirate is being forced to consider calling a halt to its expansion. Some analysts are claiming that Dubai could implode, weighed down under a pile of debt and, given that it has relatively small oil reserves, no obvious way of paying for it. One said: "This has been the most spectacular spending mission on Earth. But it's a mirage. If complex debt structures have brought the financial world to its knees, Dubai is the world's biggest toxic timebomb."

http://www.telegraph.co.uk/finance/financetopics/financialcrisis/3536012/Dubai-vows-to-keep-building-despite-global-crisis.html

------------------------

Check out the rest of this blog here.

Citigroup says gold could rise above $2,000 next year as world unravels

The bank said the damage caused by the financial excesses of the last quarter century was forcing the world's authorities to take steps that had never been tried before.

This gamble was likely to end in one of two extreme ways: with either a resurgence of inflation; or a downward spiral into depression, civil disorder, and possibly wars. Both outcomes will cause a rush for gold.

"They are throwing the kitchen sink at this," said Tom Fitzpatrick, the bank's chief technical strategist.

"The world is not going back to normal after the magnitude of what they have done. When the dust settles this will either work, and the money they have pushed into the system will feed though into an inflation shock.

more ...

------------------------

Check out the rest of this blog here.

Saturday 29 November 2008

A Shopping Guernica ?

From the Great Depression, we remember the bread lines. From the oil shocks of the 1970s, we recall lines of cars snaking from gas stations. And from our current moment, we may come to remember scenes like the one at a Long Island Wal-Mart in the dawn after Thanksgiving, when 200 frantic shoppers trampled to death an employee who stood between them and the bargains within.

It was a tragedy, yet it did not feel like an accident. All those people were there, lined up in the cold and darkness, because of sophisticated marketing forces that have produced this day now called Black Friday. They were engaging in early-morning shopping as contact sport. American business has long excelled at creating a sense of shortage amid abundance, an anxiety that one must act now or miss out.

more ...

------------------------

Check out the rest of this blog here.

Friday 28 November 2008

Is Britain going bankrupt?

The bond vigilantes are restive.

We are not yet facing a replay of the 1970s 'Gilts Strike', but we are not that far off either.

There is now a palpable fear that global investors may start to shun British debt as the budget deficit rockets to £118bn - 8 per cent of GDP - or charge a much higher price to cover default risk.

The cost of insuring against the bankruptcy of the British state has broken out - upwards - over the last month. Yes, credit default swaps (CDS) are dodgy instruments, but they are the best stress barometer that we have.

Today they reached 86 basis points, near Portuguese debt in the league table. For good reason. Alistair Darling has had to admit that the British economy faces the most sudden economic collapse since World War Two, and the worst budget deficit of any major country in the world.

more ...

------------------------

Check out the rest of this blog here.

We are not yet facing a replay of the 1970s 'Gilts Strike', but we are not that far off either.

There is now a palpable fear that global investors may start to shun British debt as the budget deficit rockets to £118bn - 8 per cent of GDP - or charge a much higher price to cover default risk.

The cost of insuring against the bankruptcy of the British state has broken out - upwards - over the last month. Yes, credit default swaps (CDS) are dodgy instruments, but they are the best stress barometer that we have.

Today they reached 86 basis points, near Portuguese debt in the league table. For good reason. Alistair Darling has had to admit that the British economy faces the most sudden economic collapse since World War Two, and the worst budget deficit of any major country in the world.

more ...

------------------------

Check out the rest of this blog here.

Warren Buffett: 10 ways to get rich

http://www.warrenbuffett.com/warren-buffett-10-ways-to-get-rich/

------------------------

Check out the rest of this blog here.

Thursday 27 November 2008

Why Unemployment Could Be Worse This Time

This fall a number of economists began predicting that unemployment would rise to 8% during this recession, up from a reading of 6.5% in October. It would be the highest jobless rate in years. But put into historical perspective, that forecast isn't too bad. A quarter of all adults were out of work during the Great Depression. More recently, unemployment reached 7.8% in the early 1990s, and climbed all the way to 11% in the beginning of the 1980s.

more ...

------------------------

Check out the rest of this blog here.

more ...

------------------------

Check out the rest of this blog here.

Wednesday 26 November 2008

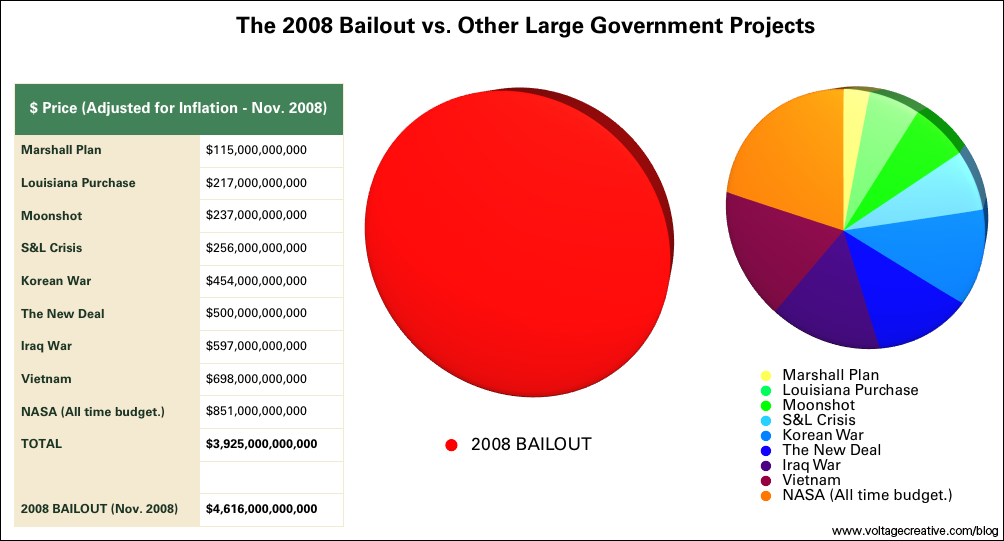

Bailout Is the Costliest U.S. Expenditure Ever

In comparison, the total U.S. cost of World War II adjusted for inflation was $3.6 trillion. The bailout will cost more than the total combined costs in today's dollars of the Marshall Plan, the Louisiana Purchase, the Korean War, the Vietnam War and the entire historical budget of NASA, including the moon landing, according to data compiled by Bianco Research.

more ...

------------------------

Check out the rest of this blog here.

Tuesday 25 November 2008

The Crash Course

The Crash Course seeks to provide you with a baseline understanding of the economy so that you can better appreciate the risks that we all face. The Intro below is separated from the rest of the sections because you'll only need to see it once...it tells you about how the Crash Course came to be.

http://www.chrismartenson.com/crashcourse

------------------------

Check out the rest of this blog here.

http://www.chrismartenson.com/crashcourse

------------------------

Check out the rest of this blog here.

History of U.S. Gov't Bailouts

http://www.propublica.org/special/government-bailouts

------------------------

Check out the rest of this blog here.

Monday 24 November 2008

Is China Headed for a Hard Landing?

The news from China in recent weeks has been dire. Strikes and protests — some of them violent and involving as many as ten thousand people — are reported almost daily. Millions of workers are being thrown out of their jobs, and economic indicators seem to presage more gloom, with electricity production for industry falling 4% in October, the first time it has declined in a decade. Even the country's seemingly insatiable thirst for oil to fuel its decades' long boom seems to be fading: China's national oil company said late in November that demand had declined "sharply" in recent months as industrial production slowed and was set to fall further.

So is China — the "fragile superpower" as one historian memorably called it — about to experience the one thing its leaders and many analysts and academics outside the country have feared for years: a violent contraction in its economy that some fear could spark widespread social unrest among its billion inhabitants?

more ...

------------------------

Check out the rest of this blog here.

So is China — the "fragile superpower" as one historian memorably called it — about to experience the one thing its leaders and many analysts and academics outside the country have feared for years: a violent contraction in its economy that some fear could spark widespread social unrest among its billion inhabitants?

more ...

------------------------

Check out the rest of this blog here.

Saturday 22 November 2008

Friday 21 November 2008

Wednesday 19 November 2008

Sunday 16 November 2008

The Money Hole

In The Know: Should The Government Stop Dumping Money Into A Giant Hole?

------------------------

Check out the rest of this blog here.

Wednesday 12 November 2008

Monday 10 November 2008

Saturday 8 November 2008

Friday 7 November 2008

Chinese economic growth will halve

Until recently, many economists had insisted that China was insulated from the global financial crisis rippling through the United States and Europe, and that the Chinese Communist Party had the tools to keep the economy chugging along. But newly released data suggests that nearly every sector of the economy is slowing and credit is tightening in a nation that has grown accustomed to sizzling hot growth.

While few economists expect China to fall into recession, analysts are forecasting the worst growth in more than a decade, with the economy expected to expand by as little as 5.8 percent in the fourth quarter this year, down from about 11 percent in 2007.

Analysts worry that a sharp downturn could undermine the country’s already weakening investment climate and impair some of China’s biggest banks, which have bankrolled much of the boom.

http://www.nytimes.com/2008/11/07/business/worldbusiness/07yuan.html?_r=1&partner=rssnyt&emc=rss&oref=slogin

------------------------

Check out the rest of this blog here.

Thursday 6 November 2008

NIALL FERGUSON on planet finance

Not so long ago, the dollar stood for a sum of gold, and bankers knew the people they lent to. The author charts the emergence of an abstract, even absurd world—call it Planet Finance—where mathematical models ignored both history and human nature, and value had no meaning.

http://www.vanityfair.com/politics/features/2008/12/banks200812?printable=true¤tPage=all

------------------------

Check out the rest of this blog here.

Palin Didn't Know Africa Is A Continent

http://www.huffingtonpost.com/2008/11/05/palin-didnt-know-africa-i_n_141653.html>

------------------------

Check out the rest of this blog here.

Wednesday 5 November 2008

Obama headlines from around the world

http://www.dailykos.com/story/2008/11/5/04621/2283/311/653622

------------------------

Check out the rest of this blog here.

Tuesday 4 November 2008

Monday 3 November 2008

The US braces for next crisis: Credit cards

The defaults that started with the sub-prime loans crisis in the US leading to a global $7.7-trillion loss in stock market value since October, are now showing signs of moving into the US credit card industry that will hit the balace sheets of the card issuing banks.

Reports indicate that a substantial portion of of the 158 million US card holders using 1.5 billion cards have started defaulting and banks had to write of approx $21 billion in bad credit loans in the first six months of this year and expect a further loss of $55 billion in the next 12 months.

more ...

------------------------

Check out the rest of this blog here.

A number of financial experts now fear that the federal government's $143 billion attempt to rescue troubled insurance giant AIG may not work

A number of financial experts now fear that the federal government's $143 billion attempt to rescue troubled insurance giant American International Group may not work, and some argue that company shareholders and taxpayers would have been better served by a bankruptcy filing.

The Treasury Department leapt to keep AIG from going bankrupt on Sept. 16, and in the past seven weeks, AIG has drawn down $90 billion in federal bailout loans. But some key AIG players argue that bankruptcy would have offered more structure and greater protections during a time of intense market volatility.

AIG declined to comment on the matter.

Echoing some other experts, Ann Rutledge, a credit derivatives expert and founding principal of R&R Consulting, said she is not sure how badly the financial system would have been rocked if the government had let AIG file for bankruptcy protection. But she fears that the government is papering over the problem with a quick fix that was not well planned.

more ...

------------------------

Check out the rest of this blog here.

The Treasury Department leapt to keep AIG from going bankrupt on Sept. 16, and in the past seven weeks, AIG has drawn down $90 billion in federal bailout loans. But some key AIG players argue that bankruptcy would have offered more structure and greater protections during a time of intense market volatility.

AIG declined to comment on the matter.

Echoing some other experts, Ann Rutledge, a credit derivatives expert and founding principal of R&R Consulting, said she is not sure how badly the financial system would have been rocked if the government had let AIG file for bankruptcy protection. But she fears that the government is papering over the problem with a quick fix that was not well planned.

more ...

------------------------

Check out the rest of this blog here.

Sunday 2 November 2008

AIG needs ever increasing amounts of bailout money to cover CDSs as the housing market declines

The American International Group said Thursday that it had been given access to the Federal Reserve’s new commercial paper program, allowing it to reduce its reliance on a costlier emergency loan from the Fed.

The company said it would be able to borrow up to $20.9 billion under the new program, raising its maximum available credit from the Fed to $144 billion under three different programs. The credit includes an earlier emergency loan of $85 billion from the Fed that carries a much higher interest rate.

A.I.G.’s big borrowings underscore the company’s bewilderingly rapid decline. When it suddenly faced a cash crisis in mid-September, the original estimate of the amount it needed was just $20 billion. A few days later, the Fed stepped forward with its $85 billion credit line. And now, the stunning size of that original bailout has grown by almost 70 percent.

more ...

------------------------

Check out the rest of this blog here.

The company said it would be able to borrow up to $20.9 billion under the new program, raising its maximum available credit from the Fed to $144 billion under three different programs. The credit includes an earlier emergency loan of $85 billion from the Fed that carries a much higher interest rate.

A.I.G.’s big borrowings underscore the company’s bewilderingly rapid decline. When it suddenly faced a cash crisis in mid-September, the original estimate of the amount it needed was just $20 billion. A few days later, the Fed stepped forward with its $85 billion credit line. And now, the stunning size of that original bailout has grown by almost 70 percent.

more ...

------------------------

Check out the rest of this blog here.

Friday 31 October 2008

Nouriel Roubini: I fear the worst is yet to come

As stock markets headed off a cliff again last week, closely followed by currencies, and as meltdown threatened entire countries such as Hungary and Iceland, one voice was in demand above all others to steer us through the gloom: that of Dr Doom.

For years Dr Doom toiled in relative obscurity as a New York University economics professor under his alias, Nouriel Roubini. But after making a series of uncannily accurate predictions about the global meltdown, Roubini has become the prophet of his age, jetting around the world dispensing his advice and latest prognostications to politicians and businessmen desperate to know what happens next – and for any answer to the crisis.

While the economic sun was shining, most other economists scoffed at Roubini and his predictions of imminent disaster. They dismissed his warnings that the sub-prime mortgage disaster would trigger a financial meltdown. They could not quite believe his view that the US mortgage giants Fannie Mae and Freddie Mac would collapse, and that the investment banks would be crushed as the world headed for a long recession.

more ...

------------------------

Check out the rest of this blog here.

For years Dr Doom toiled in relative obscurity as a New York University economics professor under his alias, Nouriel Roubini. But after making a series of uncannily accurate predictions about the global meltdown, Roubini has become the prophet of his age, jetting around the world dispensing his advice and latest prognostications to politicians and businessmen desperate to know what happens next – and for any answer to the crisis.

While the economic sun was shining, most other economists scoffed at Roubini and his predictions of imminent disaster. They dismissed his warnings that the sub-prime mortgage disaster would trigger a financial meltdown. They could not quite believe his view that the US mortgage giants Fannie Mae and Freddie Mac would collapse, and that the investment banks would be crushed as the world headed for a long recession.

more ...

------------------------

Check out the rest of this blog here.

Tuesday 28 October 2008

UK Recession Stories

http://news.bbc.co.uk/1/hi/business/7675903.stm

------------------------

Check out the rest of this blog here.

------------------------

Check out the rest of this blog here.

Monday 27 October 2008

Sunday 26 October 2008

Friday 24 October 2008

79,511 homes were lost to foreclosure in California for the three months that ended Sept. 30, a 228% increase over the same period a year earlier

The number of people losing their homes in California hit a record high of nearly 80,000 in the last three months, but a new state law appears to be dramatically slowing the foreclosure process -- at least for now.

Loan default notices, the first step toward foreclosure, fell to 94,240 for the three months that ended Sept. 30. That's down sharply from the record 121,673 for the previous quarter, according to research firm MDA DataQuick.

more ...

------------------------

Check out the rest of this blog here.

Thursday 23 October 2008

Wednesday 22 October 2008

Pensions have billions in toxic assets

Pension funds across Europe, Asia and North America stand to lose hundreds of billions of dollars from investment in so-called "toxic" assets.

Concern is also growing that clients of European private banks have also been left holding tainted mortgage-backed assets, potentially triggering a wave of litigation.

The International Monetary Fund has estimated that worldwide losses from structured products such as collateralised debt and loan obligations, asset-backed securities, commercial paper-backed securities and structured investment vehicles will hit $945bn (£546bn, €705bn), with some private estimates far higher still.

more ...

------------------------

Check out the rest of this blog here.

Concern is also growing that clients of European private banks have also been left holding tainted mortgage-backed assets, potentially triggering a wave of litigation.

The International Monetary Fund has estimated that worldwide losses from structured products such as collateralised debt and loan obligations, asset-backed securities, commercial paper-backed securities and structured investment vehicles will hit $945bn (£546bn, €705bn), with some private estimates far higher still.

more ...

------------------------

Check out the rest of this blog here.

Tuesday 21 October 2008

Monday 20 October 2008

Sarah Palin Church Video: JESUS, GIVE US A PIPELINE !

Alaska will be the refuge in the 'end of days' ??? This is a nut job church !!!

------------------------

Check out the rest of this blog here.

Sunday 19 October 2008

US house prices need to fall 43.5% from their peak to return to their post war trend price

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhl6F-wKciSy_4hlgeyQMpwQwtQek1tuFtRlxg0fG3WtkAaI_-ZPNkalra38fU20D8HC_m53wbh5OpE-Xllgve8TFOoAVIUxNhCHM9FZcaokEg6GjJ6hApGf7bJkiKHFWYO23Eq-YCdaLI/s1600-h/housing_projection.jpg

------------------------

Check out the rest of this blog here.

Saturday 18 October 2008

Obama '08 Rap

Obama '08 - Vote For Hope from MC Yogi on Vimeo.

------------------------

Check out the rest of this blog here.

Friday 17 October 2008

Thursday 16 October 2008

Tuesday 14 October 2008

Monday 13 October 2008

Friday 10 October 2008

Have shares hit rock bottom ? Is now the time to buy ?

"No one rings a bell at the bottom of a bear market," goes the old stock market adage.

Well, someone did at the bottom of the last bear market - and the unusual conditions that prompted that call have recently recurred. So have we just seen the low point of the current turmoil, and is now the time to pile back into equities?

The clever stock-watchers who got it right last time, in March 2003, reasoned that equities had become too cheap when they spotted that the income produced by investing in shares - the "yield" - had overtaken the returns from government bonds.

Why is this unusual? Bonds pay a fixed rate of return and have relatively little scope for capital growth compared with shares. Those who buy shares, by contrast, expect the income to rise over the years (along with the share price itself) and can therefore be content with a lower initial return. So to buy shares and immediately get a better income than from bonds sounds like a great deal.

Investors in 2003 agreed. They calculated that if shares had fallen far enough to push the yield so high, they had fallen too far and were clearly undervalued. The stock market started to rise, ushering in a bull market that ended only with the arrival of the credit crisis last year.

more ...

------------------------

Check out the rest of this blog here.

Well, someone did at the bottom of the last bear market - and the unusual conditions that prompted that call have recently recurred. So have we just seen the low point of the current turmoil, and is now the time to pile back into equities?

The clever stock-watchers who got it right last time, in March 2003, reasoned that equities had become too cheap when they spotted that the income produced by investing in shares - the "yield" - had overtaken the returns from government bonds.

Why is this unusual? Bonds pay a fixed rate of return and have relatively little scope for capital growth compared with shares. Those who buy shares, by contrast, expect the income to rise over the years (along with the share price itself) and can therefore be content with a lower initial return. So to buy shares and immediately get a better income than from bonds sounds like a great deal.

Investors in 2003 agreed. They calculated that if shares had fallen far enough to push the yield so high, they had fallen too far and were clearly undervalued. The stock market started to rise, ushering in a bull market that ended only with the arrival of the credit crisis last year.

more ...

------------------------

Check out the rest of this blog here.

Thursday 9 October 2008

Barack is running away with it ! 11% lead

http://www.gallup.com/poll/111040/Gallup-Daily-Obamas-Lead-Over-McCain-Expands.aspx

------------------------

Check out the rest of this blog here.

US Mortgage Reset Chart

Still lots of pain coming in US housing ! How many of these houses will be in negative equity (and thus unable to refinance at a competitive rate) when reset time comes ?

------------------------

Check out the rest of this blog here.

UK Town hall millions may be lost in Iceland

Dozens of local councils risk losing hundreds of millions of pounds of taxpayers’ money held in Iceland’s stricken banks. Town halls across the country may have to raise council tax and cut services as the repercussions of the collapse of the Icelandic economy broadened into a diplomatic row with Britain.

Alistair Darling, the Chancellor, pledged yesterday to make good all losses suffered by the 300,000 British savers caught by the collapse of Icesave, the online bank that went into receivership on Tuesday. The move will cost the Treasury about £4.5 billion — and carried an implicit pledge from Mr Darling that he would do the same if other banks collapsed. The Government also seized control of the British arm of Iceland’s Kaupthing bank because it could not honour its obligations to customers.

Mr Darling expressed incredulity that Reykjavik was cold-shouldering British investors. “The Icelandic Government have told me, believe it or not, they have no intention of honouring their obligations,” he said. Britain started legal action yesterday in an effort to recover money belonging to Icesave customers.

The Government used anti-terrorism powers to freeze an estimated £4 billion of British financial assets in Landsbanki, Icesave’s parent bank. A spokesman for the Treasury said that the 2001 Anti-Terrorism, Crime and Security Act was invoked as a “precautionary measure”.

more ...

------------------------

Check out the rest of this blog here.

Alistair Darling, the Chancellor, pledged yesterday to make good all losses suffered by the 300,000 British savers caught by the collapse of Icesave, the online bank that went into receivership on Tuesday. The move will cost the Treasury about £4.5 billion — and carried an implicit pledge from Mr Darling that he would do the same if other banks collapsed. The Government also seized control of the British arm of Iceland’s Kaupthing bank because it could not honour its obligations to customers.

Mr Darling expressed incredulity that Reykjavik was cold-shouldering British investors. “The Icelandic Government have told me, believe it or not, they have no intention of honouring their obligations,” he said. Britain started legal action yesterday in an effort to recover money belonging to Icesave customers.

The Government used anti-terrorism powers to freeze an estimated £4 billion of British financial assets in Landsbanki, Icesave’s parent bank. A spokesman for the Treasury said that the 2001 Anti-Terrorism, Crime and Security Act was invoked as a “precautionary measure”.

more ...

------------------------

Check out the rest of this blog here.

Wednesday 8 October 2008

Subscribe to:

Posts (Atom)